Altus Consulting applies the same repeatable engineered approach to delivery that it always has done to its business and technology consulting. We do this for a very good reason: with shifting regulatory requirements, complex products, multiple channels, cyber threats, legacy technology and operations that have evolved through M&A, Financial Services change is difficult. And consequently, transformation programmes have an unenviable reputation for failing, or falling short of their business case.

Our approach has always been to simplify the complicated by turning industry practitioners into consultants and supporting them with FS specific change techniques that visualise the problem and the solution. Our delivery services are no different, from inception through to implementation we help clients achieve more assured outcomes through our people and our approach.

Financial Services firms face constant challenges: rapid shifts in technology, dynamic customer expectations, fierce competition, stringent regulations, and a world that never stops evolving. Standing still is not an option, change is inevitable. Yet change as a discipline is often seen at best as a secondary activity and at worst as just an evil necessity. FS firms ARE change organisations and need to have this capability at the heart of what they do, not just to survive but as a driver for growth.

Our consulting business is focused exclusively on Financial Services change and helping clients to do this effectively. We also help them to become better at change, working with them to define the most appropriate strategy and approach, providing best practice frameworks and techniques, measuring performance and training team members.

For nearly 20 years Altus has been supporting Financial Services clients through complex transformations: from the global financial crisis, RDR and Solvency II to Consumer Duty, climate change and AI, we have helped clients to identify, plan for and deliver the change they need.

The engineered approach which has always been the hallmark of our consulting business has translated into a robust framework for tackling FS change. We have built up a team of passionate delivery practitioners who using these techniques, help clients define, mobilise and drive their programmes. Our project and programme delivery services span the full change lifecycle, whether you are shaping change, in early mobilisation, or already underway.

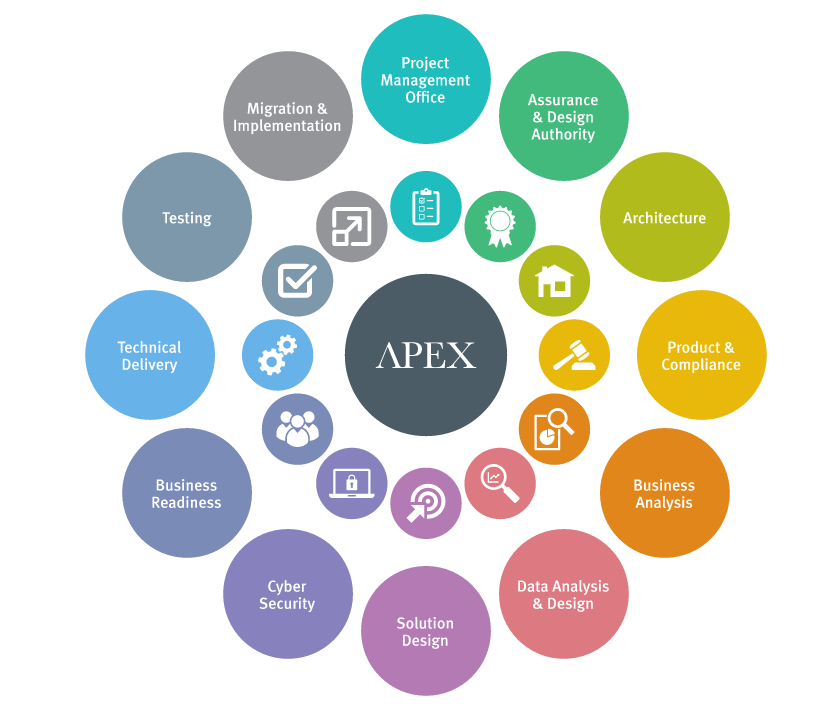

APEX is our unique online tool and framework that is the backbone of our programme delivery services.

The APEX framework brings together the major components of a Financial Services change programme into one methodology, covering project management and PMO, architecture, products and compliance, business analysis, data, solution design, cyber security, business readiness, technical delivery, testing, migration and implementation. For each, the framework houses best practice techniques refined over many years, with reference models where applicable.

Our online APEX platform brings the methodology to light and contains pre-defined playbooks tailored for many different transformation scenarios, including migrations and platform replacements. The framework and the platform are easily configured to support your FS transformation scenario, small or large.