Financial Services firms are complex organisations, interacting with customers, advisers, regulators and countless others. Understanding what needs to happen across this network is vital to meeting your clients’ needs.

Altus developed PEAK to capture this knowledge into a single tool to describe the business capabilities and processes needed to run your firm, catalogue features of your products, track and understand the impact of regulation and keep records of accountable individuals under SMCR.

It’s also an essential tool for modelling the operational impact of any change project, using a common language for clearer communication across your firm. Or use it to benchmark your business capabilities against competitors. Our consultants rely on it, meaning you can too.

Whether your role is proposition design, change management or compliance, PEAK is designed with you in mind. Talk to us today to arrange a demonstration.

With over 400 clients across the Financial Services sector, Altus has a view into the workings of numerous organisations across the industry. Whilst confidentiality constraints mean we can’t tell anyone how they compare with a particular competitor, we have been able to distil what we have seen across our clients into one consolidated view of the best (and worst) practices across a sector. That means we can help you work out how well you are doing, where your relative strengths are and where you might want to invest in improving your process or technology.

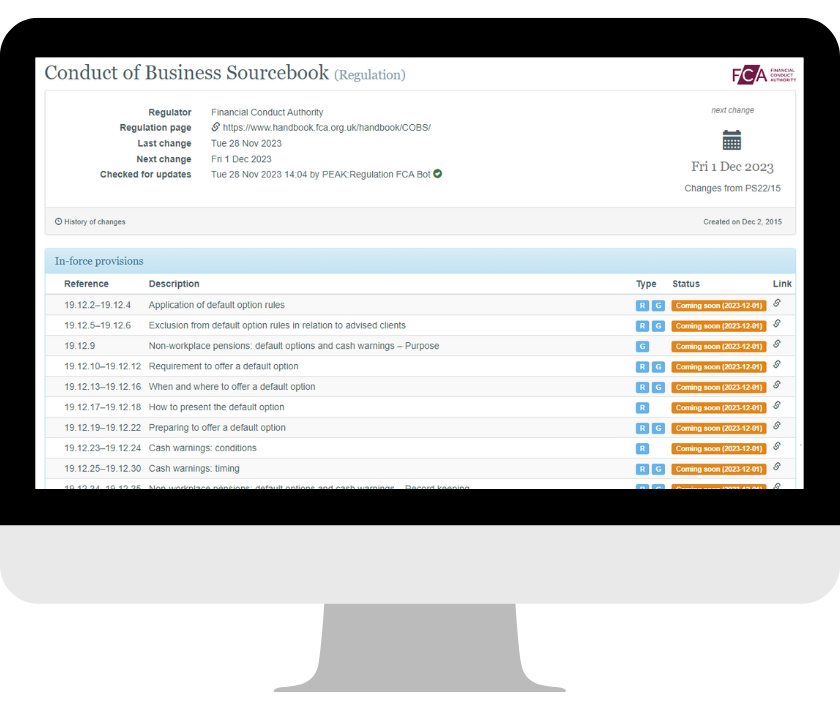

Currently over 600 of these regulations, from bodies including the FCA and HMRC, are mapped to capabilities. Users can drill into the detail of any part of the model with automatic navigation to the relevant regulation plus the ability to see all the regulations which apply to an area of the model, such as pensions.

In addition, PEAK automatically scans for new regulatory papers every day and intelligently analyses these papers for potential impacts on a model, using your mappings of regulations to capabilities. Along with the ability to visualise those impacts in bulk across multiple regulatory changes, this means you can manage your response to those changes far more efficiently. Rather than kicking off new projects for each regulatory change, PEAK will enable you to see common themes, plan more integrated projects and avoid the tendency to continually dig up the same piece of road.

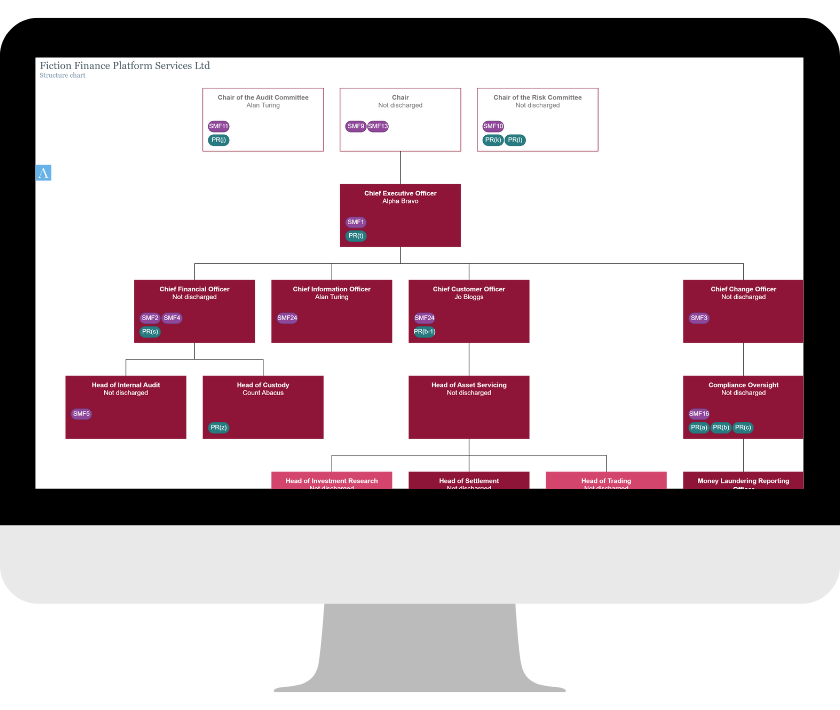

This includes the ability to map all business capabilities to an individual function and then link to specific controls for each capability. PEAK is able to use these mappings to generate SMCR structure charts plus individual Statements of Responsibility in a format which can be submitted directly to the FCA.

An optional additional module provides the ability to not just report those controls but to actively manage them and oversee compliance. The result is a comprehensive SMCR solution which enables clients to be confident that all angles have been covered, nothing has been forgotten and appropriate controls are established and operating. This rigorous approach, together with a comprehensive audit trail, provides the robust methodology a regulator will be looking for.