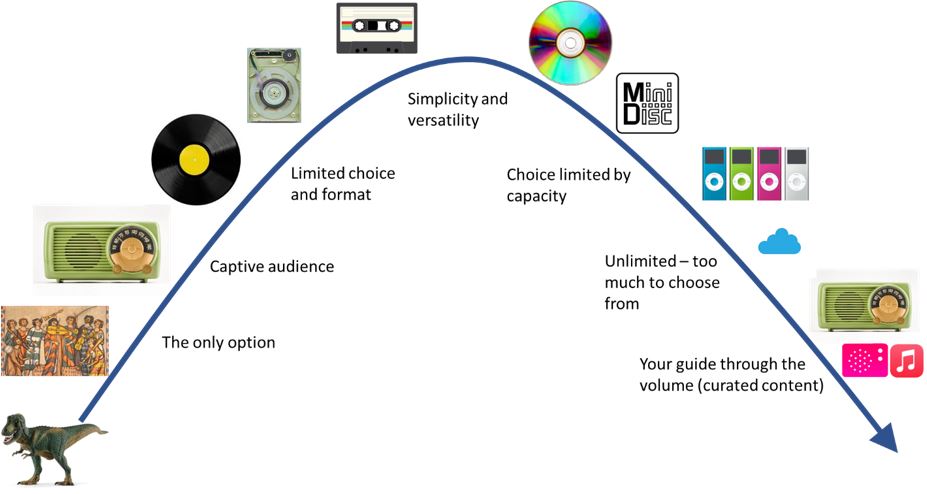

We live in a world full of choice. But with choice comes the challenge of knowing what the right decision is, and the inevitable risk of feeling choosers remorse – where we regret a decision we have made and start to think we should have made a different one. I get that with sandwiches as a small purchase, and even more so on anything with more substance and meaning. Growing up I used to get it with tapes and records when pocket money was limited and there was so much good music to choose from.

Today we know there is far too much to choose from across every aspect of life. So much so that many psychologists suggest making a small number of unimportant decisions at the start of the day, just to get you into the habit of making decisions so you’re able to reduce your dithering on the more important ones later.

Our modern world has several mechanisms to nudge us into making decisions we’re comfortable with. In the 80’s I used to listen to the radio and read Smash Hits (later NME) and they used to be my guide as to what was cool and what was not. Some reassurance that if others were buying, then so should I. Today we see similar with Amazon and “People like you also bought things like this”. With cloud and an unlimited choice of music and media I have far too much to choose from, and so I’ve given up on exploring new music trends. Instead, I either don’t listen, or I go back to tried and trusted music and tracks of old – things I’m familiar with. I’ve started to lean on my colleague Jon Dean a bit though, he’s hugely adept at hunting these things out.

Now here’s an analogy to the world of Pensions and Retirement.

There are lots of products, providers, risks, and tools. Pensions are complex. Pension regs are complex. Tax is complex. Markets are complex. Life is complex. Things change. No one could possibly build one product, or platform, that answers all these challenges in a packaged solution. If I asked you to sit down and watch a 10-hour film, the likelihood is that you’d say “No, I don’t have the appetite to do that”. But as Netflix knows, break that out into twelve 50-minute episodes then we’ll binge watch it in one. Digestible chunks. It’s the same for pension products. Workplace pensions, SIPPs, Funds, Investment Accounts, ISAs, Savings, our homes as well as a number of other things too – all those things we accumulate through our working life. Then the stuff we need once our working life is ebbing into our retirement – the full range of guaranteed income products such as annuities, enhanced annuities, deferred annuities, fixed-term annuities as well as how we manage our residual pots of investment alongside these to give us income, savings or cash when we need it – individually they all make sense. But all together, alongside tax, risk appetite, cashflow, estate and inheritance planning they get difficult to digest. Clearly the adviser community has a huge responsibility and amount to do and juggle here – all in the context of an ever-increasing focus on Consumer Duty.

How do we create a solution that is digestible? Small enough chunks that maintain understanding and interest, but packaged together so well they feel easy?

Other industries have similar challenges, although I accept the importance or consequences are of course very different. For example, the TV and media industry has changed the balance significantly between producers, distributors, and platforms – and, just for the purpose of my simplified example here, I’ll ask you to accept that this is a highly shortened and abridged version. I’m certain there were many twists and turns along the way – and that’s showbusiness as they say. In the early years, through necessity, the producers were also the distributors (Think BBC/ITV). As we demanded greater channels and choice the likes of Sky and Virgin came along, offering a much wider range of channels and content, and in the case of Sky producing content with significantly greater investment. Netflix, Amazon Prime, Disney, and Paramount all joined the party, as well as a multitude of other Freeview offerings.

From a consumer standpoint, there’s now too much to choose from in our limited spare 90 minutes on a weeknight, and either too many apps to download or not enough widget ports on the telly to have everything. So, we’ve seen the likes of Sky turn towards platform offerings, where alongside their own produced and curated content, and their own distribution, they now package together the likes of Netflix, Amazon, Disney, and Paramount all in one place – which can keep track of your watching habits, behaviour, and accounts all in one place. Some like Amazon even have packaged offerings like Freevee embedded within them – all with one easy subscription. No one loses out, and rather than cannibalising the market it grows it incrementally (cost of living aside). Occasionally the BBC and ITV will even talk about each other now too.

Sound familiar? What can Life and Pensions learn from this? Well, so far, I’d say the industry response has been fragmented at best, with portals, platforms, product providers and pension products all being designed, delivered and distributed in ways to solve certain sales problems and so taking a product centric view, rather than a Customer centric approach.

Platforms set out to be the one place (and some might say, own the customer) – but, not being insurers, they couldn’t offer guaranteed products or life insurance. Life Co’s fought back by building their own platforms, but never properly integrated the customer journey between old and new worlds. And then the FCA stepped in and said advisers need to consider using more than one platform, as using only one is unlikely to suit all Customer needs. The FCA’s drive towards shopping around, such as open-market-options and annuity quote comparisons – as well as the Pension Dashboard Programme’s stance that Dashboards must not be used as consolidation hubs all serve to further complicates matters.

In my opinion, for Consumer Duty to really work, only a more complete Customer view and blended approach will do – at the point it matters, with the Customer. Anything else might be considered isolationism. Only then can an adviser say “OK, now I’m looking at everything, from everyone, in one place I can give you the right advice”.

The illustration I started with shows how, with all that noise of what to choose from, you still need someone to bring it all together and tell you what’s cool for you. Our journey through the noise and volume of choice in the Life and Pensions world could therefore be about a refinement towards getting all the competing noises to harmonise as one, resulting in more “listening” to better curated content.