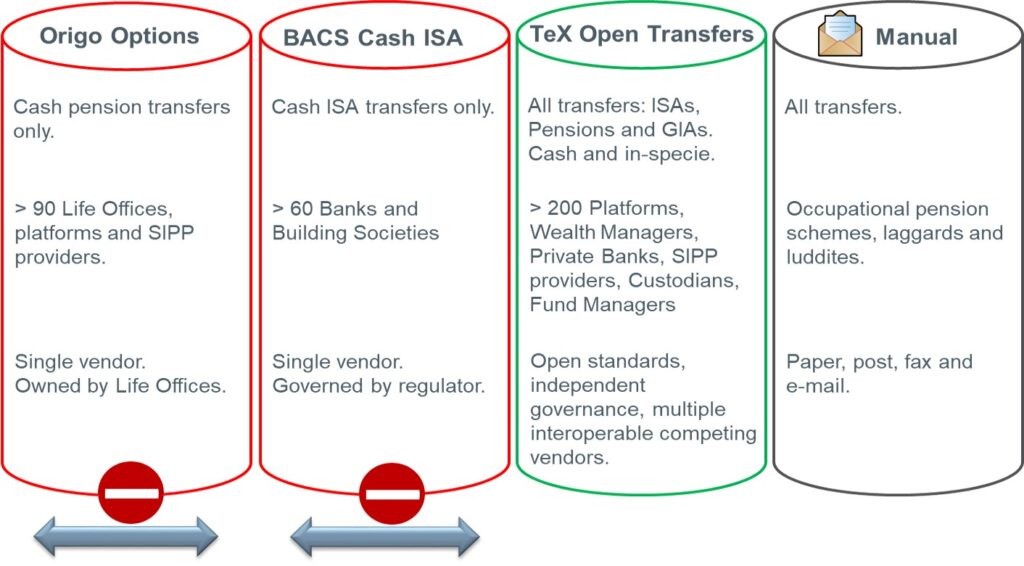

Today there are three different approaches or solutions used to automating the transfer of savings and investments.

You would think in the age of technology and Fintech transferring investments between different providers and wrappers would be a doddle. Well, it’s not quite as simple or joined up as you might expect. Transferring savings and investments between sections of the industry is not without its difficulties and dangers. These difficulties are ultimately driven by the complexities of very fragmented sets of technology solutions (and sometimes none) adopted among the different segments of the savings and investments industry.

Today there are three different approaches or solutions used to automating the transfer of savings and investments, not to mention the sections of the market that have no automation of any kind. Let’s look at these in more details:

ISAs, GIA and In-specie Asset Transfers – TeX and UK Electronic Transfers and Re-registration Group (UKETRG)

Formed out of a cross-industry initiative in response to the FCA’s RDR requirement for ‘the timely movement of accounts and assets between providers’, and led by TISA (Tax Incentivised Savings Association), it adopted an open standards approach that allows multiple vendors to provide interoperable electronic transfer solutions. TeX is a not for profit organisation owned equally by all its 100 or more members. It provides the legal, governance and SLA framework to facilitate transfers of ISAs, pensions, GIAs including the in-specie re-registration assets electronically.

TeX stipulates the use of the UK Electronic Transfers and Re-registration Group’s (UKETRG) standards. UKETRG is part of the Securities Market Practice Group (SMPG), a free to join group that is dedicated to driving automation, based on open and free standards, across a wide range of financial markets in 30 countries around the world. The majority of the market practices it governs are based on the International Standards Organisation (ISO) electronic messaging standards. For transfers, ISO 20022 messaging standards are utilised.

Since the first electronic ISA transfer in November 2012 (between Fidelity and Ascentric incorporating Schroders funds) the adoption of TeX and UKETRG to automate ISA and GIA transfers has grown to include over 200 electronic counterparties with extensive coverage among Adviser Platforms (95%), D2C platforms/Execution only Stockbrokers, Wealth Managers and Private Banks, Fund Managers (90%) and Custodians. There are at least five vendors providing interoperable solutions, including Actuare, Altus, Calastone, EuroClear and Origo.

Open transfer standards have continued to develop and the latest version (v3.0) supports a wide range of wrappers (ISAs, JISAs, GIAs, contract based pensions, Occupational Trust based DC pensions, SIPPs, SASSs etc.), asset classes (UK Funds, CREST securities including Equities, Investment Trusts and ETFs, Cash) and a range of other assets classes that you can exchange information about but not complete in-specie transfers electronically. It also includes full support for custodians in the transfer process. At the moment two versions of the open transfer standards are supported, the original v1.1 from 2012 (ISAs, GIAs, UK Funds and Cash) and v3.0 with all the wrapper and asset scope listed above. All counterparties supporting v3.0 (about 70% of platforms by AUA) have to interoperate with v1.1 counterparties so coverage is not impacted. In November 2019 v1.1 is being deprecated and all counterparties will be required to support the new v3.1 of the open transfer standards.

Pensions – Origo Options Transfers

Origo is a not-for-profit company owned by 14 of the UK’s largest Life and Pension companies. Originally set up 28 years ago as a body to manage the development of data standards for life insurance quotations and account enquiries, Origo has over the years launched a series of proprietary commercial services to support the automation of interactions between advisers and providers. One of these services, the Options Transfers, was launched in 2008 to facilitate the transfer of pension pots between pension companies and annuity providers. Today this service is widely used among LifeCos, SIPP Administrators and a couple of the bigger Master Trusts, with 90 or more ‘brands’ using the service to complete cash pension transfers electronically. In 2012 Origo extended the service to support TeX and the open standards for ISA and GIA transfers and in-specie fund re-registrations. However, the cash pension transfer service does not support the open transfer standards and remains a closed proprietary service.

While there is almost universal adoption of the Origo Options service among LifeCos and major SIPP providers, there is little to no adoption among the Trust Based Occupational DC and DB schemes and their administrators. Transfers from these type of pension schemes are still predominantly paper-based.

Cash Deposit ISAs – BACS Cash Deposit ISA Transfer Service

In response to an Office of Fair Trading (OFT) Super Complaint on delays transferring Cash Deposit ISAs between banks and building societies, the British Banking Association (BBA) led an industry initiative to automate the transfer process. The group selected the Banks Automatic Clearing System (BACS) to deliver a Cash ISA transfer service. The service was built by Vocalink, at the time BACS’s in-house IT development group, who opted to use the ISO 20022 messaging standards but with a different process model to that used by the TeX/UKETRG.

Since its launch in 2012 the number of Banks, Building Societies and other providers has risen to over 60, effectively an almost universal coverage amongst Cash ISA providers. The service has been enhanced over the years to include support for JISAs and to facilitate Cash ISA to Stocks & Shares ISA transfers. From its inception the minimum SLA to complete the transfer was set at 14 calendar days; today over 80% of Cash Deposit ISA transfers complete within 7 calendar days.

In 2016, as part of the Open Banking initiative, BACS sold Vocalink to reduce any possible conflict of interests and changed the rules to open up access to the Cash Deposit ISA transfer service and encourage third party FinTech innovation.

What next?

Over a year ago the FCA expressed concerns over the inconsistencies in consumer experiences when transferring savings and investments between products and providers. In response another industry group was formed, led by the Association of British Insurers (ABI), and incorporating a number of the trade bodies and associations including TISA, PIMFA, AMPS and PLSA. This group known as TRIG (Transfers and Reregistration Industry Group) has completed a cross-industry consultation and published a set of recommendations covering standard SLAs, industry-wide governance and adoption of open interoperable standards based approach in preference to a single supplier industry utility model.

Summary

There are three differing electronic transfer solutions supporting automated transfers of saving and investment between products and providers. Alongside, sections of the industry continue to be very manual and paper-based. It means many providers have to support at least two, if not all three, to provide a comprehensive service to customers. This is expensive and inefficient, delivers an inconsistent service that the consumer ultimately pays for in terms of poorer levels of service and higher costs.

If there was one thing the industry could do to make transfers much better for consumers, providers, regulators and providers, it would be to make all the three transfer stove pipe systems interoperate in a much more open way. Easier said than done. The vested interests in some areas are very strong and powerful. However, we can look to the Open Banking initiative as an example of interoperability and openness. It did take government and regulator intervention to achieve however.

The UK Transfer and Re-registration Landscape