License to kill?

Disruption. Innovation. Two words bandied about far too often when it comes to Financial Services. Never more so than when they appear in the same sentence as ‘robo-advice’ (or digital advice or automated advice, or any other technology metaphor you care to name).

While many new-to-market ‘robo’ propositions claim to be ‘disruptive’ or ‘innovative’, in truth a growing number of the robo-advice 1.0 propositions are sadly neither. Instead they merely follow a well-worn, linear path of:

- A lowish cost bps model, underpinned with varying degrees of sophistication towards risk assessment and ETF portfolio management.

- Through a single (D2C) channel.

- Targeting new customers, often Millennials.

- Offering ISA and GIA (and very occasionally, a SIPP).

- With an element of remote human support [Help? Guidance? Advice? Something else?]

Plenty of noise and hype? Yes. License to kill the incumbents? No.

Live and let die

I’m pretty certain the robo-advice 1.0 model isn’t what Economic Secretary, Harriet Baldwin has in mind when she talks about “disruptive innovation”. Even some of the propositions soon to hit the market are no more than slight variations on the now very common theme described above, to be launched into an increasingly crowded space, jumping on a ‘robo-advice bandwagon’. To be fair though, and not tar everyone with the same brush, we are also occasionally seeing some more refreshing thinking: different approach, different target markets, different value propositions, and different charging models. Amongst the more enlightened, there is growing recognition that B2B (partnering with a larger player) is a business model more likely to succeed than pure D2C, where the challenge to secure critical-mass and create a sustainable business is daunting. In the States, Jemstep and Betterment are good examples of businesses which have diversified and changed their business model.

Based on Altus’ consumer research, we believe that brand (a trusted reputation), scale (an extensive customer base), and reach (deep marketing pockets) are critical to success. Some Robo-1.0’s may succeed. Several will undoubtedly fail and die. Yet what they have done – brilliantly – is create an unprecedented interest and a response amongst commentators and some of the traditional incumbents not witnessed for many years.

A view to a kill

While the definition of ‘robo-advice’ varies depending on whom you talk to, Altus has identified around 70 ‘robo’ propositions / services in development in the UK, aiming to occupy space somewhere along the ‘automated’ value chain. Organisations ranging from retail banks and building societies, private banks, large and small distributors, asset managers, retail platforms, larger tech vendors, fintech start-ups, and more, are all clamouring for a piece of the action… and looking to kill off their rivals.

In the UK, ‘big brand’ robo-advice 2.0 is now in development, just as we’ve witnessed in the States. The likes of Vanguard, Schwab, Fidelity and the banks are all developing their own ‘robo’ services, and validating the ‘robo’ model as a legitimate alternative to the traditional face-to-face model.

Robo-advice 2.0 will be brought to market by well-known names, big high-street brands, affinity groups, and even as part of an employer’s workplace proposition. Vertically integrated and omni-channel, they aim to meet broad customer needs rather than simply providing a narrow investment proposition. Key to success will be the ability to aggregate customers’ personal finances and integrate people into the overall experience.

With an existing loyal (or at least ‘sticky’) customer base of millions of people, far deeper pockets than the robo-1.0 players, and FCA and Treasury backing through Project Innovate, FAMR, and the Regulatory Sandbox, the time has come for the banking and building society sectors to really make a positive difference to millions of people in the UK. However, just being an incumbent big brand is not enough. If they want to compete with online trading platforms or emerging Peer-to-Peer matchmakers, they will need to change their internal thinking, processes and culture.

“We’ve seen this movie before. This is precisely what happened in the mid-1990s with the advent of online banking. Internet-only banks like NetBank and TeleBank were the innovators, the disruptors. But they all failed or sold out once the traditional brick-and-mortar giants…threw around their weight. Just like Schwab is doing versus the robo-advisors, once Bank of America ramped up its online banking platform, it was adding more accounts every 90 days than the independents did in five years. It’s a one-sided fight.” Walt Bettinger, CEO, Charles Schwab

Diamonds are forever

To get a quality proposition to market quickly, the established big brands will need to partner with a combination of established technology suppliers and smaller fintech firms and resist the temptation to ‘go solo’ and design and build it all internally. We have witnessed the ‘let’s build it all in-house’ approach far too many times to know that, more often than not, it ends in frustration, delays, high costs, and inferior adviser and / or customer propositions.

Skyfall

‘Robo-advice’ – now a term that’s on the agenda across the Square Mile and beyond – generating much activity in the financial services sector. Who’d have thought it even 12 months ago? Yet it’s very clear that the world we live in is changing, and changing rapidly. The way we interact with, and buy, services is changing too. Just look at the apps on your smartphone, think about the ones you personally use most, or hear about:

- Social media, such as Facebook, LinkedIn, Twitter, Snapchat, Messenger, WhatsApp.

- Google.

- Apple iTunes, Spotify, and Netflix.

- AirBnB and Uber.

None of these organisations / apps ‘own’ what they’re famous for, whether it be content, music and entertainment, property or taxis. Yet they are the places we spend more and more of our time. And every day many of us quite happily share and receive a whole host of data about ourselves, about what and who we like, about our finances, our hopes and dreams, our health – from these and a variety of other apps.

So unless the financial services incumbents – or even the new ‘robo’ pretenders to the throne – up their game and really re-imaginewhat the future will look like, rather than just re-engineering what the financial services sector already does, don’t be surprised if the financial services landscape, and the brands supporting it, looks very different in a few years from where we are today. The sky is about to fall on some very famous heads…

With $multi-billions investment, we’re now witnessing incredible advances in artificial intelligence, Big Data analytics, telematics, biometrics, digital payments, chat bots, VR and AR. New ‘smart-connected’ services underpinned by these technologies are coming together like never before. And in time, they will be able to work out what consumers need – before they know it themselves – and to proactively serve up solutions that are perfectly tailored to each individual, in a rich, engaging way.

From China with love

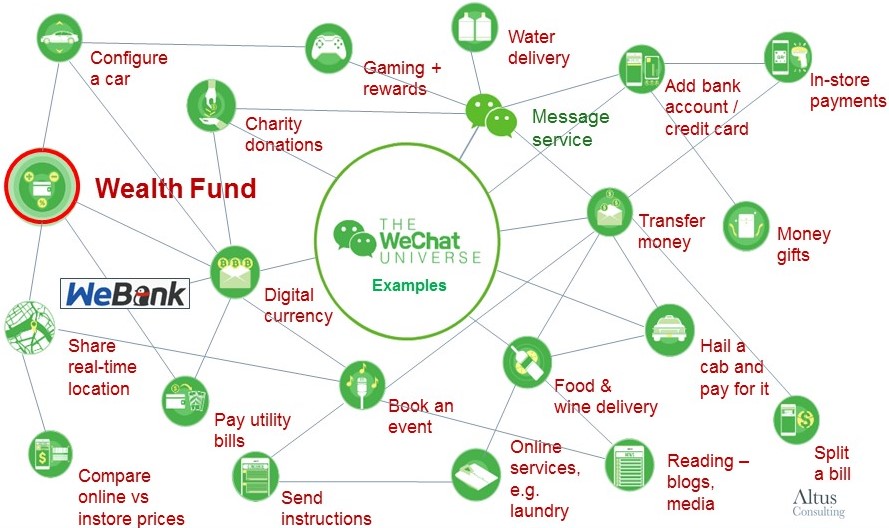

Take a look at your smartphone again. See the little Messenger app? Remember when it used to be integrated into Facebook to enable you to private message your online friends? Well, now it’s a Platform in its own right, which means it can integrate a whole host of other apps. For example, in the States a user can order and digitally pay for an Uber taxi, or flowers, or other services. And if we look overseas to China, we can see that this ‘Platform as a Market’ concept has really captured the imagination and taken hold. WeChat, the Chinese equivalent of Messenger, allows users to do all the standard activities such as send and receive messages and pictures, share location, play games, and so on. And like Facebook’s Messenger, it will also let users order and digitally pay for a taxi. But it also allows users to do literally dozens of other things too, such as:

- In-store and online shopping using a digital wallet.

- Transfer money to friends or businesses.

- Catch up on reading – blogs, newspapers, magazines, articles.

- Order weekly groceries.

- Pay utility bills.

- Buy a whole range discounted products and services.

- And amongst many other activities, even configure a new car.

All very interesting, but what has any of this got to do with financial services, or specifically, robo-advice?

Well, as part of their platform, or digital ecosystem, WeChat also offers banking services through WeBank… and offers a really fast, slick way to invest into a money fund.

Illustration 1: The WeChat universe example services – the sign of things to come in the UK?

Through WeChat, Alibaba (the Chinese equivalent of Amazon), and similar services, over 200 million people – 1 in 6 of the Chinese population – have invested into money funds, and last year total assets were around US $350 billion. And from a user perspective it really is easy, frictionless, simple and quick. A cash transfer from an Alibaba customer’s bank account into their money fund using the group’s Alipay online payment system takes just one-click.

The world is not enough

If you live in China, you can, realistically, use no other app but WeChat all day. So now imagine Amazon – or Facebook, or Google, or Apple – doing the same in the States, in the UK… or anywhere else in the world?

They will. Maybe not directly. But just as we’ve seen elsewhere, they’ll partner with an online challenger bank, a forward-thinking asset manager… and have access to every smartphone user on the planet. And it will happen sooner than you think: in the UK, AJ Bell recently completed the purchase of £500 Facebook shares through the Messenger app; real disruption in our industry is a matter of ‘when’, not ‘if’.

The extent of ‘Platform as a Market’ is only limited by our imaginations, and will present a very different picture of ‘robo-advice’. Driven by technology visionaries, this will become something much, much bigger, not restricted by industry boundaries, and far-removed from anything we currently see or hear about in the UK or even the States. This is innovation. This is real disruption.

While acknowledging the great strides the FCA has made through Project Innovate and the recently launched Regulatory Sandbox, and the Treasury’s desire for London to be the Fintech capital of the world, I can’t help but feel that the outcomes of FAMR – by comparison to the rapid changes we see in technology and social behaviours across the world – are off the pace, slow, sluggish. FAMR was an amazing opportunity for the industry to really get a grip and take action, to recognise what is now possible, to re-imagine how to connect to the mass market, to the mass affluent, to the different sub-segments of Millennials, to the changing attitudes of people generally. Yet we have had a consultation process that has reported back recommending a host of further consultations. Pension Dashboards to be delivered in 2019? Why?! Too slow! If the industry doesn’t get a grip and start moving at pace, we can be pretty certain that the financial landscape in 5 years’ time will look very different from today, and there will be a lotof blood on the floor.

“I am the CEO and I am paid to be paranoid, and I am paranoid about this… I do not see Google manufacturing funds but I can see them coming in and distributing funds.” Martin Gilbert, CEO and Co-Founder, Aberdeen Asset Management

Never say never

A smart-connected open API platform – a platform where consumers spend a significant amount of their time – activated by a swipe or a ‘conversation’ with their own Siri 3.0 equivalent chat bot, and providing easy access to a whole range of discounted goods and services, supporting secure, fast micro-payments and configured to their specific needs, ambitions, and desires; that’s where we’re heading. We now occupy a world where we have a target market of one, and where the requirement to have significant wealth is no longer a major barrier to saving and investing.

Not convinced? Never say never. This type of proposition feels far more in-tune to the evolving behaviours and attitudes of today’s consumers than many current financial services offerings, which continue to invest huge sums of money in their own ‘walled garden’ websites, where they still think they are the centre of a consumer’s universe – they’re not. They still think they own the customer – they don’t. They still don’t allow their (extremely) well-paid leaders to take accountability and make real decisions without multiple layers of governance and approval committees. And the old marketing textbooks that talked about large, homogenous segments can be thrown in the bin. Outdated approach. Outdated thinking. Time for change.

Die another day

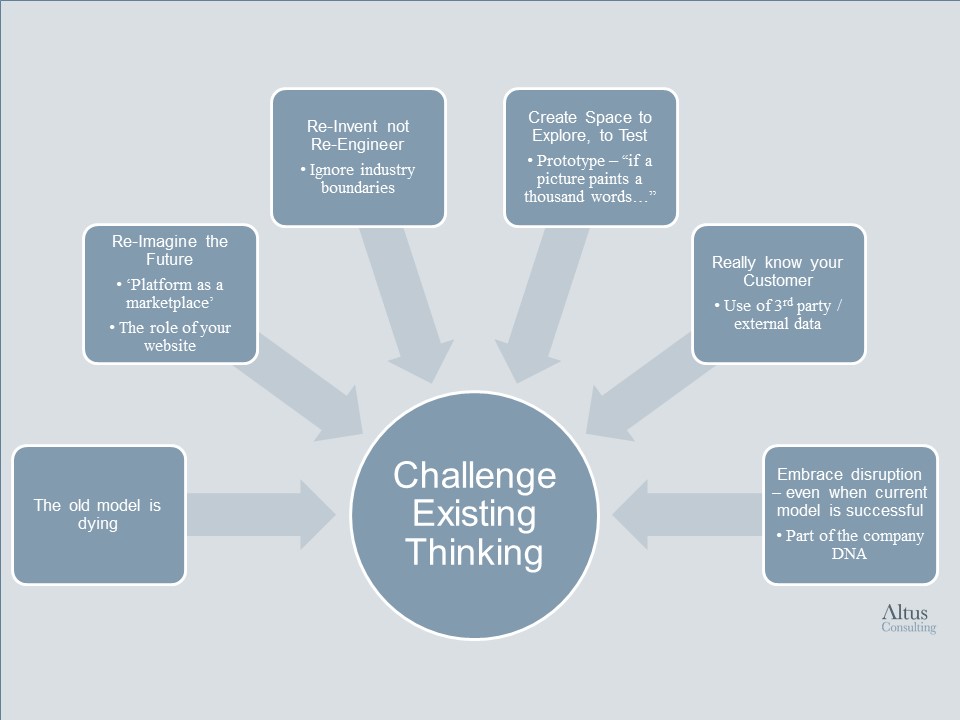

Illustration 2: Time to challenge existing thinking

Kodak and Blockbuster are often used as classic examples of businesses that were ‘disrupted’. Yet what is often overlooked is that Kodak invented the digital camera… but were worried it would cannibalise their existing camera and film business; Blockbuster had the opportunity to acquire Netflix… and decided against it. In other words, companies often know where disruption is likely to come from, but take the wrong strategic decision.

It really is time to challenge existing thinking (illustration 2), and start asking some big questions: What’s your purpose? What role will you play in this new world order? How long will you remain relevant? Does your leadership team understand and use the platforms that consumers use, or are they unaware, or perhaps think they’re not relevant?

The world is changing. Will you disrupt? Or be disrupted? And die another day.

First published in MoneyFacts Investment Life & Pensions July 2016