Hands-up those who has watched the friendly “buy, hold, sell” video shared by PayPal? Crypto currencies bitcoin, bitcoin Cash, Litecoin and Ethereum, available from your sofa, at the click of a button.

Of course (buried in the small print) the crypto currency cannot be used for payments in the UK.

Is this the acceptable face of risk, a game, a bit of fun?

The risk of trading crypto currencies is mainly related to its volatility, these are high risk speculative investments, no better or worse than “traditional” high risk investments. But, they come with two additional challenges, firstly, people don’t understand what they are buying. Ok, a bit of faith is necessary in pretty much all investments today. Secondly, these investments are likely to be hit with regulations in the future when governments wake up to their revenue generation potential.

With crypto currency most people don’t understand what they are buying, and this is compounded by its mathematical nature. Generally, as humans, we are not good at understanding risk, and in particular differentiating between correlations and coincidence.

And the cheese?

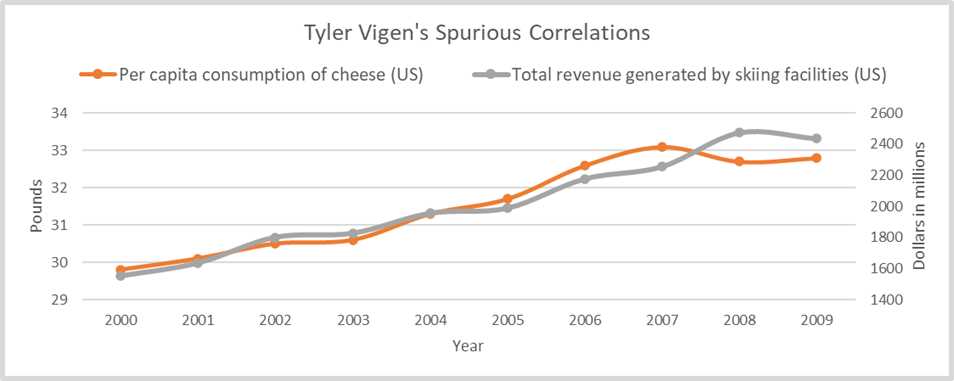

From Tyler Vigen’s brilliant “Spurious Correlations” we can see the consumption of cheese appears to closely relate to the total revenue generated by skiing facilities. It would be totally rational to conclude that if you increase your consumption of cheese, this will increase your use of skiing facilities, and in-turn improve your skiing.

Of course, this is nonsense, it’s a coincidence, not a correlation. The majority of us do not understand correlations and risks, or mathematics in general. And crypto currency is a wonderful application of mathematics, impenetrable to the majority of us.

Smart people deal with the crypto currency, so we can leave the details to them? Right? Wrong. Earlier this month a small crypto asset trading platform, DeversiFi, accidentally paid a $24 million commission. This was due to a blockchain related software glitch. In a show of amazing honesty, the amount was repaid, and realising how incredibly fortunate he was, the CEO of DeversiFi, commented “I wouldn’t personally recommend to anyone else to rely on the goodwill of strangers on the Internet”.

Is PayPal’s crypto currency trading any worse than encouraging other high risk investment activity? That’s not the question we should be asking. PayPal is enabling you to trade in crypto currency as easily as adding a song to a playlist, offering high-risk trading to anyone, without the high-risk warnings or any form of protection. Contrast that with traditional high-risk investments offered by regulated firms, which are typically only available to professional clients and sophisticated investors who have significant sums of money in the first place, those who can afford to lose their investment.

Not all virtual currencies survive. Many have failed (1984 at the time of writing), some were Ponzi schemes, others suffered catastrophic hacks, and many became valueless. In light of this, we should consider the wider financial framework in which crypto currencies operate. In the UK the FCA’s role is to protect consumers, keep the industry stable, and promote healthy competition between financial service providers. Is it therefore reasonable that the FCA considers levelling the regulatory playing field and ensure PayPal, and other exchanges selling crypto currencies, comply with FCA regulations and their implicit consumer protections?

As consumers we are tempted by quick fixes, such as crypto currency will make you rich, or cheese makes you ski better. To separate good crypto currency decisions from bad, we must educate ourselves and make informed decisions, but the regulatory authorities also have a key role to play. Then we can reap the rewards (in cheese?).