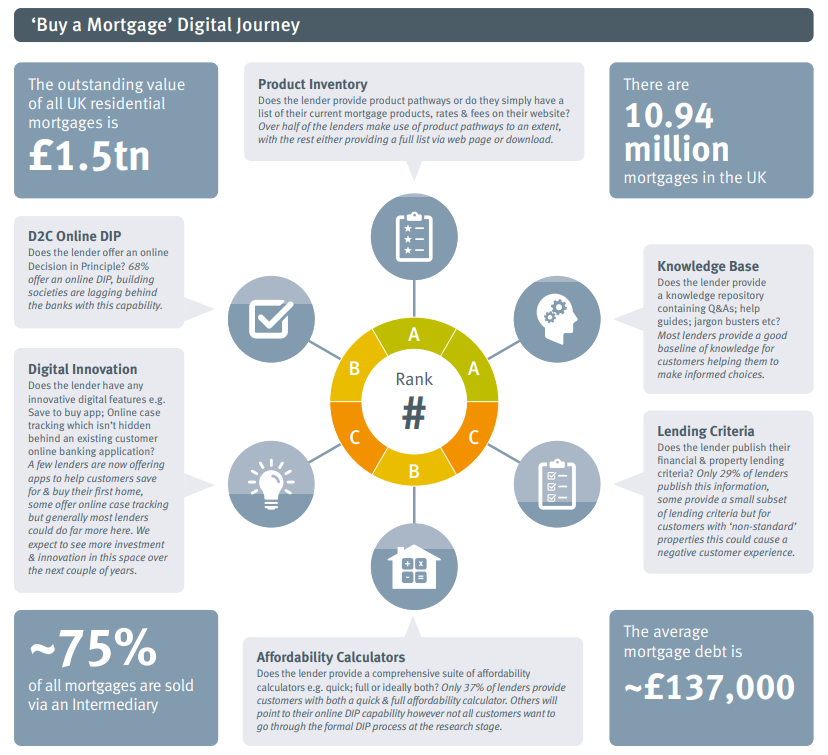

Our second infographic in the series illustrates some of our key findings around digital maturity of UK high street mortgage lenders (direct to consumer – buy a mortgage journey).

As you would expect, most lenders have the basics covered with 68% offering an online Decision in Principle (DIP), suggesting the main lenders have ‘done digital’.

Looking ahead, increased access to and sharing of data across the end to end homebuying journey (supported by Open Finance & third Party APIs) will improve customer experience and operational efficiency.