In 2015 Altus researched digital offerings from the leading General Insurers and the results were disappointing if not altogether unsurprising.

With the ever increasing uptake of mobile technology Altus’ consultants were interested in understanding to what extent the leading General Insurance (GI) providers had embraced this change in technology.

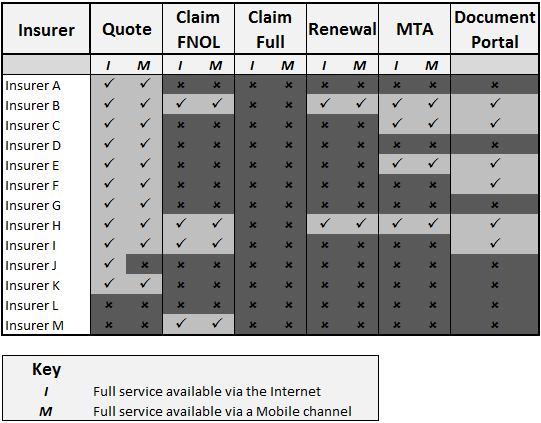

Altus identified 13 of the leading personal lines home and motor GI providers with ~90% market share and conducted a scan of their websites. This research determined how viable it was for a customer to complete key transactions via mobile and digital channels.

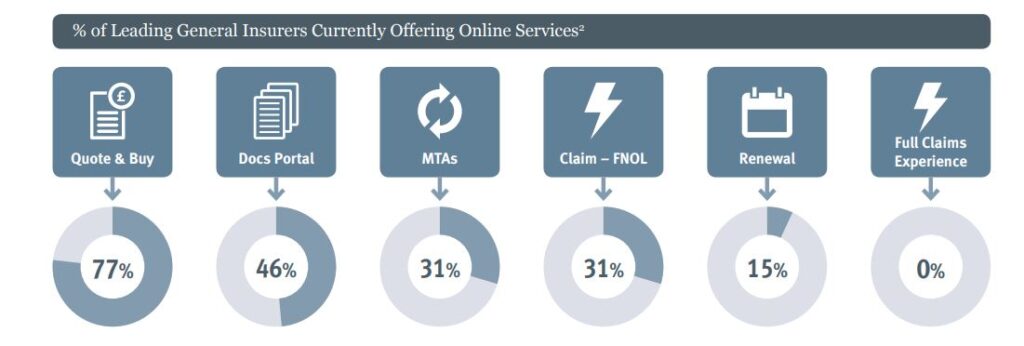

The key transactions and % of Insurers who can service their customers via a digital channel were as follows:

- Could a customer (or prospective customer) complete a quotation and purchase a new policy – 85% online & 77% mobile

- Could a customer complete an MTA – 31% online & mobile

- Could a customer amend their policy at the point of renewal – 15% online & mobile

- Could a customer notify their Insurer of a loss (FNOL) – 31% online & mobile

- Could a customer complete an e2e claims transaction – 0% online or mobile

- Could a customer access their documents through a secure portal – 46%

The results highlighted that the industry as a whole is a long way off of being ’digitally enabled’.